55668

IllumyFi

Investors one-stop shop solution

Italy

Market: Information and media, Financial services, Artificial Intelligence

Stage of the project: Operating business

Date of last change: 23.09.2024

Italy

Market: Information and media, Financial services, Artificial Intelligence

Stage of the project: Operating business

Date of last change: 23.09.2024

Idea

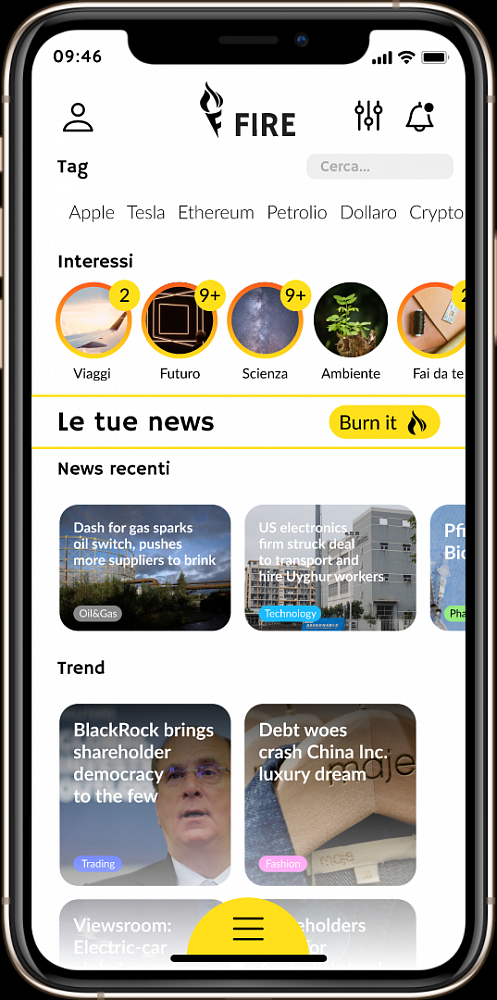

We are the new front-end of the financial sector: an all-in-one personalized platform for investors (from learning, to portfolio management) to put your finances on autopilot

Current Status

We raised €220k in 2023, to develop MVP: news aggregator tool powered by AI to personalize users' newsfeed based on their interests & portfolios.

We signed 2 pilots with two top10 Italian Banks allowing them to customize their offering based on our data.

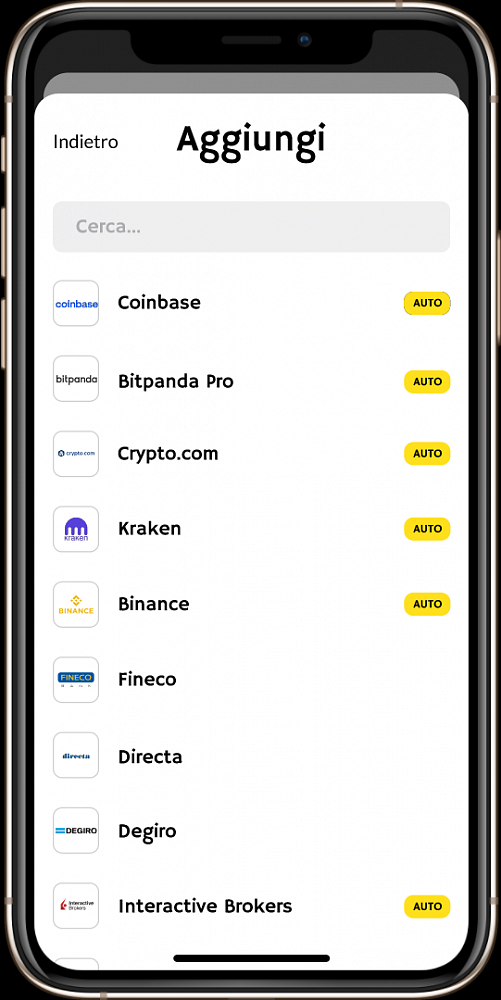

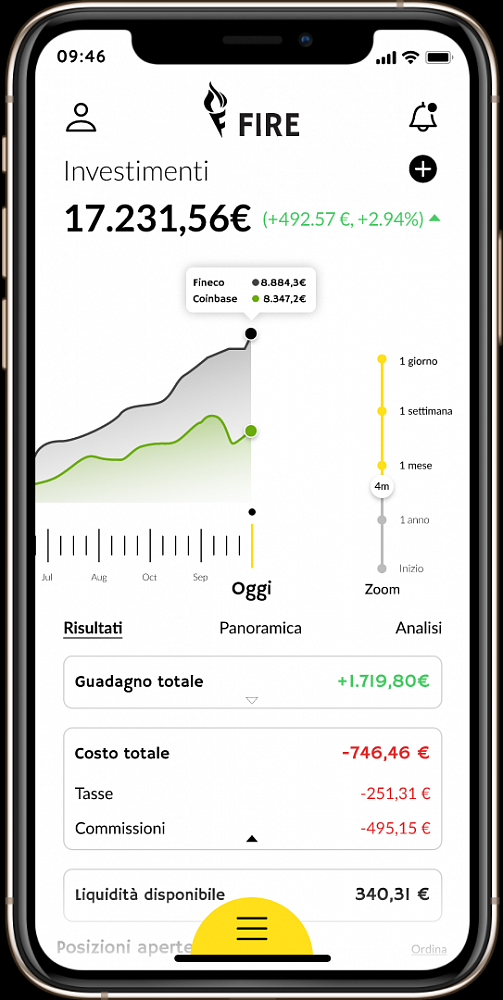

We also developed an AI algorithm to automatically aggregate your financial portfolios, leveraging PSD2 APIs. First solution of its kind in Europe, anticipating by 4+ years the new Open Finance regulation.

We signed a mutual reseller partnership with SaltEdge.

An Italian banks also signed LOI for future learning service.

We signed 2 pilots with two top10 Italian Banks allowing them to customize their offering based on our data.

We also developed an AI algorithm to automatically aggregate your financial portfolios, leveraging PSD2 APIs. First solution of its kind in Europe, anticipating by 4+ years the new Open Finance regulation.

We signed a mutual reseller partnership with SaltEdge.

An Italian banks also signed LOI for future learning service.

Market

- B2B: Financial Institutions, in particular those which offer investment services

- B2C:

> Early adopter: current investors, under 50 years old [1.1M people in Italy]

> General adopter: investors, every age [15M people in Italy, 160M in Europe, 100% in 2020]

The general market is estimated at $ 25T with 6% CAGR. Niches like wealth management and crypto are worth respectively $ 1.1T (10% CAGR) and $ 3T.

- B2C:

> Early adopter: current investors, under 50 years old [1.1M people in Italy]

> General adopter: investors, every age [15M people in Italy, 160M in Europe, 100% in 2020]

The general market is estimated at $ 25T with 6% CAGR. Niches like wealth management and crypto are worth respectively $ 1.1T (10% CAGR) and $ 3T.

Problem or Opportunity

In the last decade the Financial sector has changed, due to 4 major trends:

- Democratization: lower fees for everyone

- Decentralization: crypto and DeFi

- Social wisdom: the rise of social media (e.g. GameStop case, Twitter crypto Team)

- Open Finance: by 2024 the EU will complete its OF framework

But a problem has risen from all of this: extreme fragmentation within the FS. Investors are lost among the 2-300k applications out there: an investor on average has 4+ financial apps, with an average subscription between 10-15$/mo and spends 2h a day managing her finances.

- Democratization: lower fees for everyone

- Decentralization: crypto and DeFi

- Social wisdom: the rise of social media (e.g. GameStop case, Twitter crypto Team)

- Open Finance: by 2024 the EU will complete its OF framework

But a problem has risen from all of this: extreme fragmentation within the FS. Investors are lost among the 2-300k applications out there: an investor on average has 4+ financial apps, with an average subscription between 10-15$/mo and spends 2h a day managing her finances.

Solution (product or service)

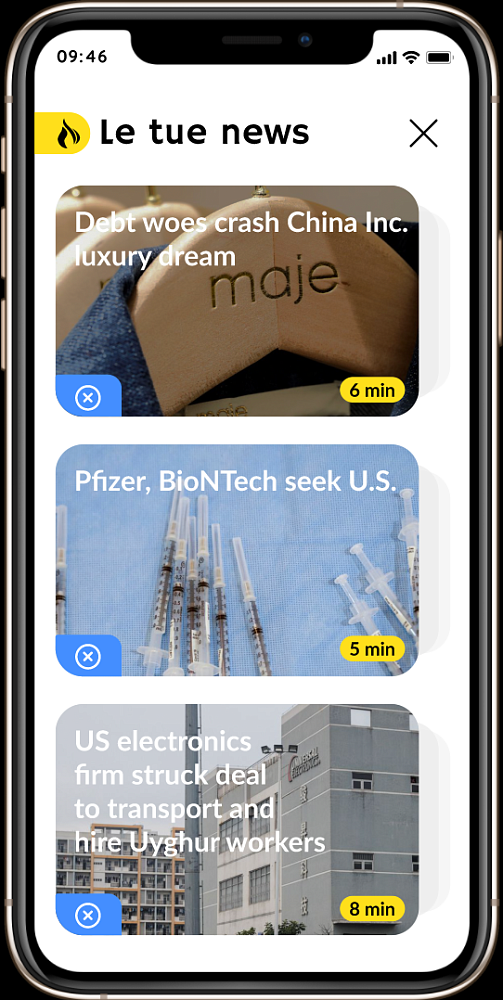

IllumyFi will become the new front-end of the financial sector: one place to access and manage all the services out there, to put your finances on autopilot.

Imagine a place where you could sell your bitcoin on Coinbase and buy apple stock on Robinhood, without juggling between different apps; all while accessing personalized financial information, learning how to invest, contacting your advisor, etc.

Imagine a place where you could sell your bitcoin on Coinbase and buy apple stock on Robinhood, without juggling between different apps; all while accessing personalized financial information, learning how to invest, contacting your advisor, etc.

Competitors

Portfolio aggregator:

- Delta: crypto portfolio aggregator startup acquired by eToro in 2019, with 1.5M customers

- ShareSight: traditional portfolio aggregator startup, with 0.4M customers

News aggregator:

- Seeking Alpha

- Investing.com

- Delta: crypto portfolio aggregator startup acquired by eToro in 2019, with 1.5M customers

- ShareSight: traditional portfolio aggregator startup, with 0.4M customers

News aggregator:

- Seeking Alpha

- Investing.com

Advantages or differentiators

- Union of the 2 worlds: portfolio and news aggregation

- AI algorithm to personalize news content

- Aggregation of social media as well as traditional media

- AI algorithm to personalize news content

- Aggregation of social media as well as traditional media

Finance

Revenue:

- B2B: one-off fee for PoC development and integration + annual fee

- B2C: Freemium model with 2 tiers + Pay-per-use

- B2C2B: fixed/variable fee on third parties' products acquired by customers

Cost:

All first year activities (from IT dev to legal) will be covered by FoolFarm, our Venture builder partner. The only other costs will be related to the salaries of the CEO and CTO (selection ongoing)

- B2B: one-off fee for PoC development and integration + annual fee

- B2C: Freemium model with 2 tiers + Pay-per-use

- B2C2B: fixed/variable fee on third parties' products acquired by customers

Cost:

All first year activities (from IT dev to legal) will be covered by FoolFarm, our Venture builder partner. The only other costs will be related to the salaries of the CEO and CTO (selection ongoing)

Business model

- B2B: SaaS model, initially targeting banks offering investment services. Our GTM relies on targeting CMOs and Head of Investment/Advisory respectively for the news and portfolio offering

- B2C: Freemium model, initially targeting millenial do-it-yourself investors. The B2C also functions as a showcase for B2B targets.

- B2C: Freemium model, initially targeting millenial do-it-yourself investors. The B2C also functions as a showcase for B2B targets.

Money will be spent on

- 53% product development

- 38% HR and other

- 9% marketing

- 38% HR and other

- 9% marketing

Offer for investor

We are raising 300k with a 2M pre-money valuation.

We have already gathered 70k in soft commitments.

We have already gathered 70k in soft commitments.

Team or Management

Risks

- Behavior of competitors that might decide to compete

- Difficulty in scaling on the B2C

- Difficulty in scaling on the B2C

Incubation/Acceleration programs accomplishment

INNOVIT Startup Bootcamp program in SF: 2 weeks in SF sponsored by the Italian Innovation Center (September 2024)

Global Startup Program: 4 weeks in London sponsored by the Italian Trade Agency (November 2024)

Global Startup Program: 4 weeks in London sponsored by the Italian Trade Agency (November 2024)

Won the competition and other awards

No participation in competitions at the moment

Photos

Product Video

Presentation

Sign in/Sign up