47328

MANIMA

Craftswomenship and Smart Technology in Luxury

Italy

Market: Culture and art, Production, Other

Stage of the project: Prototype or product is ready

Date of last change: 29.05.2020

Italy

Market: Culture and art, Production, Other

Stage of the project: Prototype or product is ready

Date of last change: 29.05.2020

Idea

Di Pasquale Guthmann is an Italian innovative start up with social purpose which valorizes the cultural handcraft patrimony of Italian embroidery by

adopting a widespread manufacturing model, allowing women to work from anywhere in Italy, by using advanced technologies and digitalisation to enable scalability (i.e. ERP, integrated systems, AI, AR/VR, RFID, virtual showroom, 360 imaging) and a competitive top edge and future-proof innovative commercialisation model in the luxury segment.

adopting a widespread manufacturing model, allowing women to work from anywhere in Italy, by using advanced technologies and digitalisation to enable scalability (i.e. ERP, integrated systems, AI, AR/VR, RFID, virtual showroom, 360 imaging) and a competitive top edge and future-proof innovative commercialisation model in the luxury segment.

Current Status

We have completed the validation phase in the field both B2C and B2B, acquiring about 70 VIP clients in the US, UK, France and UAE with an average spend of €1500 and a conversion rate of 80% in private trunkshows, as well as successful trunkshow in Moda Operandi. We have designed the technological eco-system and production process to start scaling up.

Market

Our target are global HNWIs who with a global average wealth per capita of about 4$m ub 2917 are expected to grow across all geographies with a 18-23 CAGR of over +4%. Europe and APAC will experience the highest growth, respectively +4,4% and +4,2% (World Wealth Report 2019, Capgemini, Wealth Report 2019 Knight Frank).

Within the global luxury market, we position ourselves in the personal luxury market which accounted for 22% of the overall global luxury market value, with Accessories and apparel accounting for about €161bn. The market is expected to reach €320-330bn by 2025 (+10-11% CAGR 20-25), surging after the COVID-19 outbreak.

According to McKinsey, if the current pandemic is contained and growth rebounds, sales levels should be reached again by all the main regions by Q2 2021. Both Bain&Company as well as McKinsey and the Global Luxury Expert Network sustain a strengthening of consumer ethics and local price, as well as increasing concern about sustainability and brands conscious habits.

Within the global luxury market, we position ourselves in the personal luxury market which accounted for 22% of the overall global luxury market value, with Accessories and apparel accounting for about €161bn. The market is expected to reach €320-330bn by 2025 (+10-11% CAGR 20-25), surging after the COVID-19 outbreak.

According to McKinsey, if the current pandemic is contained and growth rebounds, sales levels should be reached again by all the main regions by Q2 2021. Both Bain&Company as well as McKinsey and the Global Luxury Expert Network sustain a strengthening of consumer ethics and local price, as well as increasing concern about sustainability and brands conscious habits.

Problem or Opportunity

Italy ranks among the worst countries in the EU for women employment rate, with ~43% overall unemployment rate. The number grows if only the South of Italy is considered (~59%). Italy is in 117th place

in the word for women participation to National

economic development (over 153 countries analysed).

At the same time Italy has a large base of workers employed in artisanal manufacturing. In 2017, small artisanal enterprises production was €43.5b, of which €7.8b was exported. The value generated by small artisanal enterprises in Italy was over €43bn.

At the same time Italy has a large base of workers employed in artisanal manufacturing. In 2017, small artisanal enterprises production was €43.5b, of which €7.8b was exported. The value generated by small artisanal enterprises in Italy was over €43bn.

Solution (product or service)

Use one of the most important assets in Italy - high quality artisanship - to create work opportunities for women with little or no professional skills in underserved areas of the country, by creating an innovative scalable model of widespread manufacturing using advanced integrated technologies to manage processes, connect workers and successfully commercialise our products to global discerning UHNW clients.

Competitors

Houria Tazi, Morocco

Houria Tazi is a brand that has reached some celebrity for her handpainted and embroidered table linens. Her products are mainly sold through stockists like Mary Mahoney Palmbeach, Sabrina Montecarlo and some sel ect home linens etailers. All products are handmade in Morocco and the product lines are focused on placemats and napkins.

Noël-Paris

Noël is a traditional brand from Paris that exists since 1883 and was successfully re-launched in 1992. Noël features very high quality hand and machine embroideries and offers a wider range of Home linens with a personalization service for yachts and private jets.

Renaissance Paris

Renaissance is a French brand that offers very traditional style embroideries for the Home.

No revenue data are available for these companies.

Inspiring comparator brands

Brunello Cucinelli

World famous Italian cashmere brand that has conquered the world of luxury with its concept of “Humanistic Capitalism”. The brand has reached >€550m in revenues in 2018

All Birds

B-Corp shoes brand which produces shoes sustainable merino wools shoes. The company has raised over €150m in funding

Stella McCartney

One of the first sustainable fashion brands, it was part of theKering Luxury group and it now collaborated with the LVMH group. The company has annual revenues for about €300m

Vivienne Westwood

Pioneer brand of sustainability offering a vast range of products, fr om fashion to home decor. Vivienne Westwood has annual revenues of about €52m.

Houria Tazi is a brand that has reached some celebrity for her handpainted and embroidered table linens. Her products are mainly sold through stockists like Mary Mahoney Palmbeach, Sabrina Montecarlo and some sel ect home linens etailers. All products are handmade in Morocco and the product lines are focused on placemats and napkins.

Noël-Paris

Noël is a traditional brand from Paris that exists since 1883 and was successfully re-launched in 1992. Noël features very high quality hand and machine embroideries and offers a wider range of Home linens with a personalization service for yachts and private jets.

Renaissance Paris

Renaissance is a French brand that offers very traditional style embroideries for the Home.

No revenue data are available for these companies.

Inspiring comparator brands

Brunello Cucinelli

World famous Italian cashmere brand that has conquered the world of luxury with its concept of “Humanistic Capitalism”. The brand has reached >€550m in revenues in 2018

All Birds

B-Corp shoes brand which produces shoes sustainable merino wools shoes. The company has raised over €150m in funding

Stella McCartney

One of the first sustainable fashion brands, it was part of theKering Luxury group and it now collaborated with the LVMH group. The company has annual revenues for about €300m

Vivienne Westwood

Pioneer brand of sustainability offering a vast range of products, fr om fashion to home decor. Vivienne Westwood has annual revenues of about €52m.

Advantages or differentiators

Our brand is completely sustainable and based on ethical values. Authenticity and transparency are not a marketing tool, but part of our DNA. Sustainability and respect for people in the making of our products are imperatives in everything we make.

Our products are all one-in-a-kind, highest quality and long-lasting and respond to the growing need of personalised products in a world of mass-production.

Our model allows for us to be flexible and dynamic and to be independent from fragile supply structures.

Our products are all one-in-a-kind, highest quality and long-lasting and respond to the growing need of personalised products in a world of mass-production.

Our model allows for us to be flexible and dynamic and to be independent from fragile supply structures.

Finance

BP reaching €5.82m revenues in 2024, with 37% EBITDA (€2,17m) and 16 DOS.

The planned growth sees in 2023 and 2024 two crucial years to reach the planned revenues, with retail offline and direct online channel playing a key role as main growth drivers. driven by a strong digitalisation and technological production optimisation that leads to a significant higher margins compared to traditional business models.

The forecasted growth is organic and estimated to reach the following CAGRs 2021-24: +130% in Net Sales, +97% in Wholesale, +50% in e-tailers, +127% retail online (46% of revenues) and +196% (40% of revenues) and in the offline retail segment.

Directly operated channels (retail online and retail offline) are supposed to increase their relevance on total sales, reaching 87% of overall sales by 2024.

Marketing & Sales Expenses go from 50% on revenues in 2021 to 17% in 2024. BP growth in %: '21: 7% '22: 16% '23: 24% '24: 53%

1. Product development

2. Immediate creation of our new e-commerce website

3. Content creation (photoshootings, product photographs, editorial contents)

4. Rapid implementation of the technological eco-system for the production and the commercialization 5. Training course for new embroiderers

The planned growth sees in 2023 and 2024 two crucial years to reach the planned revenues, with retail offline and direct online channel playing a key role as main growth drivers. driven by a strong digitalisation and technological production optimisation that leads to a significant higher margins compared to traditional business models.

The forecasted growth is organic and estimated to reach the following CAGRs 2021-24: +130% in Net Sales, +97% in Wholesale, +50% in e-tailers, +127% retail online (46% of revenues) and +196% (40% of revenues) and in the offline retail segment.

Directly operated channels (retail online and retail offline) are supposed to increase their relevance on total sales, reaching 87% of overall sales by 2024.

Marketing & Sales Expenses go from 50% on revenues in 2021 to 17% in 2024. BP growth in %: '21: 7% '22: 16% '23: 24% '24: 53%

1. Product development

2. Immediate creation of our new e-commerce website

3. Content creation (photoshootings, product photographs, editorial contents)

4. Rapid implementation of the technological eco-system for the production and the commercialization 5. Training course for new embroiderers

Business model

The Brand offers three different product lines with increasing levels of customization and a differentiated increasing average price: ready-to-wear products, semi-customized and fully customized items. Ready- to-wear products are offered in limited collections for immediate buy, the other lines are pre-ordered.

The products are sold both via direct to customers channels managed by the Company (such as pop up shops, trunk shows and e-commerce) and indirect channels, managed by third parties (luxury boutiques and luxury e-tailers).

The B2B channel focuses on the acquisition of clients among the top e-tailers like Moda Operandi, Net- à-Porter and Farfetch through the use of a virtual showroom (Joor) allowing to manage the wholesale channel effectively fr om pre-market (line sheet preparation), to the in-market one stop shopping destination with a digital storefront that allows to invite retailers to view catalogs and view available inventory and to post-market tools for order management and real time sales reporting.

The B2C channel operates both off- and online and focuses on a strong growth of the latter. Off-line sales are generated through selected stockists, as well as through innovative temporary pop-up stores and trunkshows in strategic locations like yacht marinas and luxury destinations in and outside Italy (Capri, Positano), wh ere virtual tools like AR and digital installations and dedicated spaces for customization are used to enhance the direct consumer experience.

The products are sold both via direct to customers channels managed by the Company (such as pop up shops, trunk shows and e-commerce) and indirect channels, managed by third parties (luxury boutiques and luxury e-tailers).

The B2B channel focuses on the acquisition of clients among the top e-tailers like Moda Operandi, Net- à-Porter and Farfetch through the use of a virtual showroom (Joor) allowing to manage the wholesale channel effectively fr om pre-market (line sheet preparation), to the in-market one stop shopping destination with a digital storefront that allows to invite retailers to view catalogs and view available inventory and to post-market tools for order management and real time sales reporting.

The B2C channel operates both off- and online and focuses on a strong growth of the latter. Off-line sales are generated through selected stockists, as well as through innovative temporary pop-up stores and trunkshows in strategic locations like yacht marinas and luxury destinations in and outside Italy (Capri, Positano), wh ere virtual tools like AR and digital installations and dedicated spaces for customization are used to enhance the direct consumer experience.

Money will be spent on

Proceeds will be mainly used to hiring of new key figures and sustain Marketing activities

Offer for investor

Current round offering 33,33% for €1.5m at a pre-money valuation of €3.0m. Request for two thirds of capital in public funding (€1m) submitted with expected approval in July.

Team or Management

Risks

Production bottlenecks in the transition to a larger scale manufacturing and delays in the implementation of the needed technology tools.

Unexpected market risks like the current pandemic.

Unexpected market risks like the current pandemic.

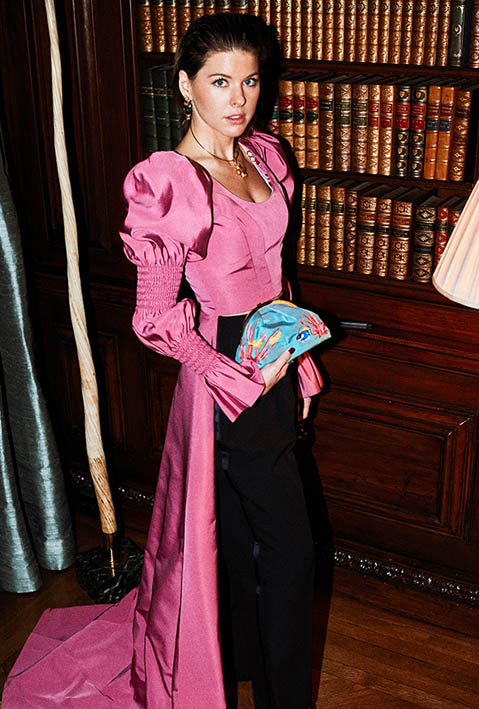

Photos

Product Video

Presentation

Sign in/Sign up