40175

Indiemodal, Inc.

Drayage Cooperative Network

USA, California

Market: Logistics and warehouses, Transport, Services

Stage of the project: Operating business

Date of last change: 25.07.2019

USA, California

Market: Logistics and warehouses, Transport, Services

Stage of the project: Operating business

Date of last change: 25.07.2019

Idea

Create and provide flexible drayage capacity network utilizing Owner Operators & small drayage trucking companies for all stakeholders to improve visibility, efficiency, productivity.

Container posting - Trip match - bid process creates virtual market place for fast paced drayage industry, improve load-capacity imbalance, speed up truck turn time at the port, enhance street turn to reduce bobtail run and to save trips per move.

Container posting - Trip match - bid process creates virtual market place for fast paced drayage industry, improve load-capacity imbalance, speed up truck turn time at the port, enhance street turn to reduce bobtail run and to save trips per move.

Current Status

Minimum Viable Product developed. Started selling service in June. 1st, 2019.

Generating revenue of $20,000/month. 30 Owner Operators and Trucking Companies, and 12 shippers signed up. Need funding to grow.

Generating revenue of $20,000/month. 30 Owner Operators and Trucking Companies, and 12 shippers signed up. Need funding to grow.

Market

* 52 Million TEU US Port Container Traffic (2017 Excluding transloading or empty repositioning: U.S. Army Corps of Engineers / More than 62 Million estimated 2019)

* 62 Million TEU NAFTA Port Container Traffic (2017, The World Bank2017 / More than 753 Million TEU Worldwide)

* 350,000 Owner Operators in US

* OTR (Over-The-Road, FTL long distance): $350 Billion for-hire FTL Market (2018, American Trucking Association, $739 Billion All Mode of Trucking Market)

* 8,000 UIIA Registered Drayage Trucking Companies

* 62 Million TEU NAFTA Port Container Traffic (2017, The World Bank2017 / More than 753 Million TEU Worldwide)

* 350,000 Owner Operators in US

* OTR (Over-The-Road, FTL long distance): $350 Billion for-hire FTL Market (2018, American Trucking Association, $739 Billion All Mode of Trucking Market)

* 8,000 UIIA Registered Drayage Trucking Companies

Problem or Opportunity

- Load-Capacity Imbalance (driver shortage)

- Operational Inefficiency (fragmented industry structure, legacy I.T.)

- High Turnover Rate of Owner Operators (high cost of recruiting)

- Frequent Labor Classification Lawsuit

- Operational Inefficiency (fragmented industry structure, legacy I.T.)

- High Turnover Rate of Owner Operators (high cost of recruiting)

- Frequent Labor Classification Lawsuit

Solution (product or service)

Matching capacity in Cooperative Drayage Network with all stakholders in the industry, providing multiple source of work for Owner Operators, and flexible capacity for Shippers and Trucking Companies.

- Bid Request w/ Trip matching

- Job Posting / Bid Process / Assign

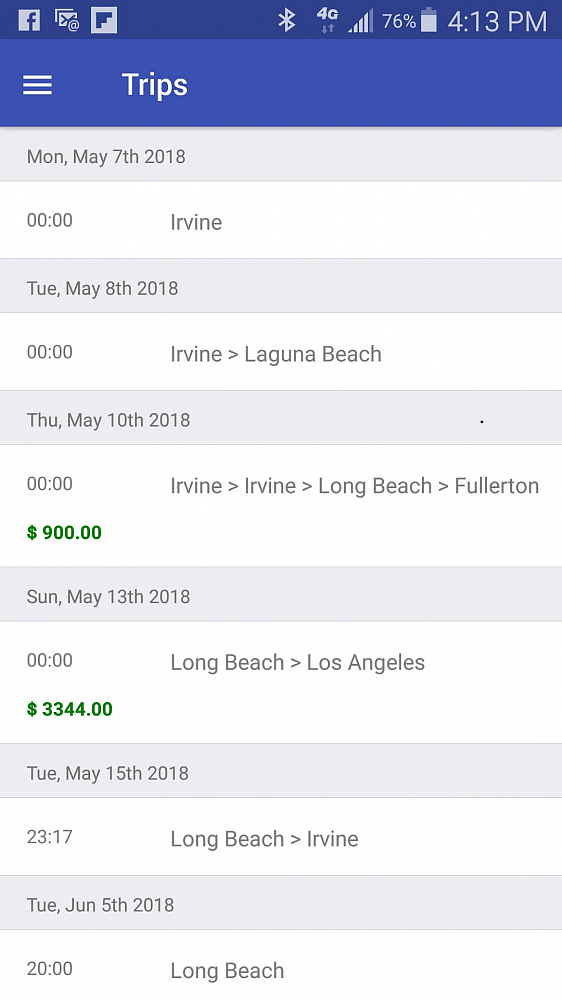

- Real-time visibility

- Empty Container & Chassis Availability Information for Street Turn

- Promote more Free-Flow operation

- Automated document management

- Place Bid / Accept, Assign, Dispatch

- Document Posting (Photo, In-person Signature)

- Earning Record - Minimize pay dispute

- Loaction Tracking

- Multiple source of work - no labor dispute

Competitors

- Dray Alliance: Direct Competition, $3.5 million Seed Round. Market Share unknown. Higher Pricing, less payout to driver.

- Next Trucking: OTR is main business, launched mobile app for drayage and yard for pre-pull. Market Share unknown. Inefficient Operation due to lack of Drayage Experience.

- Cargomatics: going after asset based operation model.

- Next Trucking: OTR is main business, launched mobile app for drayage and yard for pre-pull. Market Share unknown. Inefficient Operation due to lack of Drayage Experience.

- Cargomatics: going after asset based operation model.

Advantages or differentiators

- Lower Pricing: efficient dispatch through trip matching and Streen Turn, yet better payout for drivers

- Drayage focused Web/Mobile App and Operation: bettter service

- Benefits all stake holders, not only shippers.

- Oganize Free Flow for Truckig Companies

- Drayage focused Web/Mobile App and Operation: bettter service

- Benefits all stake holders, not only shippers.

- Oganize Free Flow for Truckig Companies

Finance

* 1% of market share, 30% margin on avg. $400 drayage=$74.4 million

* 1st year (by end of May 2020): container move/month = 1,200 container move/month

* 5th year: 100,000 container move/month

* Free Flow / Street Turn Subscription fee: 10% of Drayage Trucking Companies, $200/month=$160,000/month

* 1st year (by end of May 2020): container move/month = 1,200 container move/month

* 5th year: 100,000 container move/month

* Free Flow / Street Turn Subscription fee: 10% of Drayage Trucking Companies, $200/month=$160,000/month

Business model

* Margin on Shpper's Drayage Rate & Owner Operator's Bid price (or preset contract rate)

* Commission on Drayage Rate

* Subscription Fee for Street Turn Listing

* Participation fee for Free Flow

* Commission on Drayage Rate

* Subscription Fee for Street Turn Listing

* Participation fee for Free Flow

Money will be spent on

- Adding features to Web & Mobile App.

- Additional Staff

- Operation Expense (Client's Rolling Credit)

- Expand to major Container Ports

- Additional Staff

- Operation Expense (Client's Rolling Credit)

- Expand to major Container Ports

Offer for investor

We like to offer 20% share for $2,000,000 investment

Team or Management

Risks

- Owenr Operator's adoption of technology: place bid/post pod in time

- Drayage Trucking Companies's perception of the business model: may see us as competition instead of partner

- Rolling Credit: 15~45 days credit term is norm in the industry this maybe financial burden

- Ever changing DOT regulation & labor regulation

- Drayage Trucking Companies's perception of the business model: may see us as competition instead of partner

- Rolling Credit: 15~45 days credit term is norm in the industry this maybe financial burden

- Ever changing DOT regulation & labor regulation

Photos

Product Video

Presentation

Sign in/Sign up